See the good in colleagues and stay inquisitive to make up for shortcomings

Winnie Wong shares her secret of success

Winnie Wong (95/SC/English and Translation) is named “Chi Shun” in Chinese. While “Chi” is shared among family members of her generation, “Shun” carries her parents' hopes for her to be a humble person. This was fully displayed throughout the interview, when she repeatedly said that she isn't smart enough and that her achievements are built upon extra hard work and continuous learning to gain new experiences. Her modest personality has helped to build bonds extensively, with the support from her superiors and getting along with colleagues. Winnie believes that learning from others with an open mind, having mutual respect for one another, and knowing how to appreciate and explore the strength in colleagues are the key pillars of her winning management philosophy.

A well-mannered lady who speaks softly, Winnie does not come across as the stereotypical extrovert in the insurance industry. She recalls the advice from her classmates with humour: firstly, do not manage people as her soft personality would be easily taken advantage of; secondly, do not go into business because the chances of her being cheated is quite high. Now heading two insurance companies, she is actively engaged in both of these areas. However, Winnie admits that when she first joined CUHK, she had not thought about working in the commercial sector. “I received a conditional offer from CUHK. Based on my academic results, my parents suggested me to enroll in business administration. Luckily, they did not give me a lot of pressure and let me make my own choice. Since I have always enjoyed reading, and was fortunate to have the guidance of a few good teachers from secondary school, I opted for the Department of English. When the Department of Translation was established in my second year, they picked 10 students each from the departments of Chinese and English respectively. I was among the firsts to graduate with English and Translation.”

Winnie describes herself as super shy during her studies. Secondary school teachers used to say that her voice was so soft that it barely makes a sound, and that they need to give her a microphone when she answered questions in class. These changed fundamentally during Year 3 when she went to the United States on exchange. “I stayed at the student hostel during my second year, and my roommate was an exchange student from the University of California. With her influence, I was determined to go studying abroad, so I applied to go on exchange to University of California. To make the most of the precious opportunity, I enrolled in subjects that were not available in Hong Kong at the time, and others that address my weaknesses. For example, I chose a Public Speaking course to improve my presentation and language skills. It was tough not only because English is not my mother tongue, but I also need to manage the stress of speaking in front of a large audience. Also, as I have been weak at sports, I took an elective course in golf. As expected, I did not make excellent grade but I can say that I have tried. These experiences in stepping outside of my comfort zone have had a great impact in my life.”

Winnie Wong (6th from right) went on exchange to the United States, where she enrolled in subjects that she was not exposed to in Hong Kong at the time. She was photographed in a Japanese class.

Being an emcee to train response

With a willingness to try everything, Winnie applied for several jobs upon her graduation – from the public sector to banking and commercial firms, to name a few. Beyond her expectation, she went through rounds of interviews and received offers from most applications. “I decided to take on the Management Trainee role at Swire Group. After seven rounds of interviews, the managing directors met with us and introduced their job functions. The talk on the insurance business really impressed me. The representative said that all people and every company are our potential clients, which means we are in position to help everyone. This is very meaningful, so I chose insurance. I believe I have made the right move, as my training was meticulously planned to address my weaknesses. The superiors know that I am an introvert, so they assigned me to be the emcee for the annual dinners. In the first year, I felt really nervous but managed it. I was most thankful for the company for sponsoring me to pursue a MBA, so that I could make up for my limited knowledge in business administration. This has been very helpful to me.”

Being the emcee for annual dinners, Winnie Wong (front) enjoys the opportunity to brush up her public speaking and communication skills.

Earning respect bit by bit

By continuing to gear up herself with new knowledge and skills, Winnie thinks she has stayed pretty much the same person. “Successful leaders are not defined by a certain set of qualities, so I think the best way is to stay true to yourself. When you treat people nicely, they would do the same. In recognition of my efforts, my superiors have trusted me and given me opportunities for promotions every year or two, so that I could try different positions. When I first joined the company, I already met a great challenge in managing staff members including some who are older and more experienced. It was most important to stay humble, and be ready to learn from them. Once you have built the confidence, you are able to help other colleagues and earn their respect through this process. Never expect the respect of others simply by being in a position of power. It must be earned bit by bit over time.”

Apart from being easy to get along, Winnie's management philosophy has also played a key role in winning respect. “I do not like to micro-manage. My colleagues should have opportunities to use their talents. To me, the greatest sense of satisfaction is witnessing the growth and promotion of my colleagues. Even those who are seen by others to be less capable, they must have some talents over you. When you understand how to appreciate the strengths in others, you are able to learn from them. Colleagues need empowerment from me to tackle their tasks independently. Everyone has their own strengths and weaknesses. The secret is to assign them to an appropriate position, they will be satisfied and thrive.”

Insurance technology – more than innovation

Insurance technology, or insurtech, has gained momentum in recent years. To leverage this trend, Winne has established Avo Insurance to focus on virtual insurance, in addition to her role as Chief Executive Officer of Asia Insurance. “With a higher population and a larger market, insurance technology has been rapidly growing on the Mainland. For insurance companies, it presents a promising prospect that is worthy of huge investments into digital transformation. Even though insurtech is developing in Hong Kong, the city has a smaller market. This means that after careful calculation in break-even analysis, insurance companies may have reservations in investing even in strong ideas, which is quite regretful. This is why the local industry is looking forward to bigger opportunities in the Greater Bay Area. Frankly, the local insurtech and fintech start-ups are doing quite well, but Hong Kong's limited market size may not be sufficient for them to fully grow.”

Winnie Wong spoke at the Digital Insurance Agenda conference at Munich, Germany last year. She presented the development of insurance technology in Hong Kong.

The staff demographic profile and company culture of Asia Insurance and Avo Insurance are quite different to one another. Winnie says jokingly that she needs to adopt different personae when she goes back and forth between the two offices. “Avo colleagues are generally younger, averaging around 20-something of age, and almost half of them have an information technology (IT) background. Their culture is very different to Asia Insurance. The management structure of Avo must be flat with fewer hierarchies. I talk with the staff frequently, and mingle with them during events. I have learned so much from colleagues in both companies. For Avo, in particular, since it targets at a younger demographic, it is important to understand the insurance needs from the young people's perspective and design the user experience accordingly.”

As the first virtual insurance company to receive full license from the Insurance Authority, Avo Insurance has been able to ride on the recent wave of technological advancement. However, Winnie believes there will be many more challenges ahead. “The pandemic has truly reshaped the citizen's way of life, making them purchase with their mobile phones. Purchasing insurance on a handset will remain as a challenge. Unlike daily groceries, insurance is non-tangible which means the purchasing decision is based on back-end service. Therefore, we made fitting changes to our existing products, and developed innovative new ones to attract customers, like insurance for e-wallets to meet its increasing usage, coverage for working at home during the pandemic, or even insurance for getting the COVID-19 vaccine. We must innovate and keep up with market needs.”

Other than innovation, insurance technology can also help to reduce insurance premium. “In the past, insurance products seem very complicated because it includes many unnecessary items. For example, cancer insurance has always been expensive because it covers all kinds of cancers. By focusing the coverage to the eight most common types of cancers in Hong Kong, we are able to roll out a new product to the market at a significantly lower cost compared to traditional insurance. Our clients also pointed out that gender differences may affect the type of cancers caught, so we further tailored our plans for male and female clients. We have also simplified the insurance products, and streamlined the number of questions in the registration workflow. We hope to simplify the customer journey, and breaks the image that insurance is very complicated, hence enabling more people to benefit from it. This is a new direction for the industry.”

Asia Insurance rolls out the “Asia iCare” under the Voluntary Health Insurance Scheme (VHIS) in 2021, partnering with CUHK Medical Centre. Winnie (1st from left) attended the launching press briefing.

Promoting female and senior colleagues

Being a long-established industry, insurance was male-dominated when Winnie first joined its ranks. She recalls, “There were only a few females at the cocktail parties. I was not good at socialising and suffer from allergies when I drink alcohol. When the men started talking about football, I was unable to join the conversation. Therefore, the only thing I could do was to do my best at the office and pay extra efforts. I have fought for equal opportunity, like arrangements for pre-natal leave to provide more flexibility for female colleagues to take care of their family and work commitments, thus reducing the loss of talents in this way. Diversity is important for the insurance business, because our clients are of different genders, backgrounds and nationalities. A more diverse workforce puts us in a better position to understand the needs of different clients. Furthermore, diversity is not limited to gender. We also extend staff members' service beyond the age of 60. Their wealth of experience are invaluable lessons for the new colleagues. If they are physically fit for work, we would strive to allow senior colleagues to stay beyond retirement.”

Having served the Hong Kong Financial Services Development Council over the past eight years, Winnie Wong (1st from right) has learned about finance matters outside of insurance industry.

“My secretary says I'm a softy. On top of this workload, I still take on public services. However, I feel that I am learning so much from these engagements. For example, serving on the Hong Kong Financial Services Development Council over the past eight years has allowed me to learn about other finance matters outside of the insurance profession. The opportunity to collaborate with experts in different fields has motivated me to make the best effort to manage my time for it.

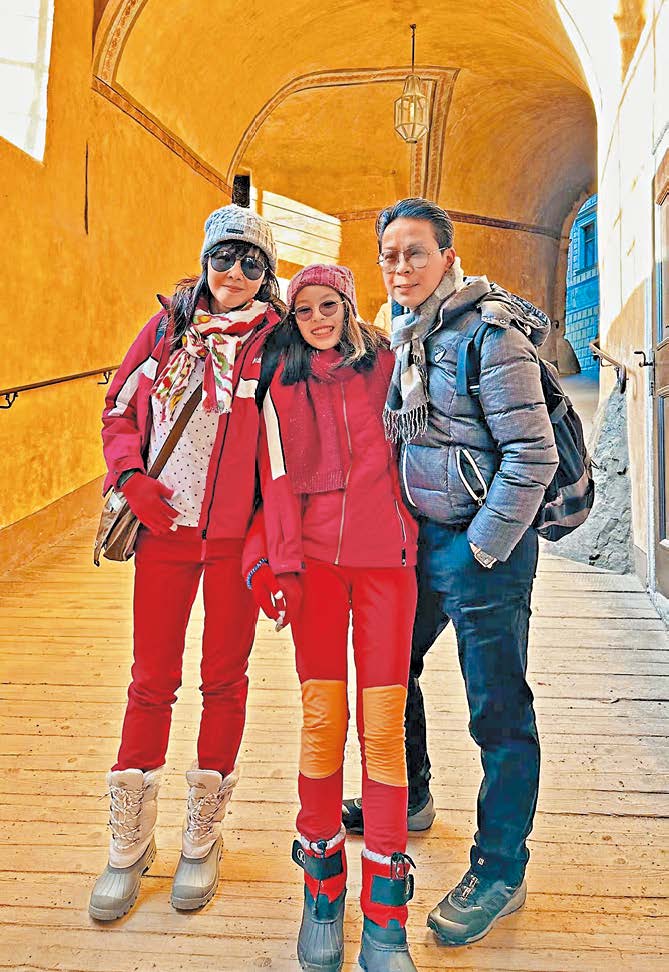

With good time management, Winnie finds sufficient time to take care of her daughter (middle) besides her work commitments.

Winnie Wong's Profile

- 1995‧Graduated in BA in English and Translation, CUHK

- 1995‧Group Management Trainee, Swire Group

- 2000‧Graduated in MBA, HKUST

- 2002‧Assistant General Manager, an Insurance Company under Swire Group

- 2003‧Director & Head of Global & Risk Managed Accounts, Aon Risk Solutions

- 2008‧The first Chairlady, Hong Kong Insurers' Club Limited

- 2012‧Chief Executive Officer, Aon Risk Solutions

- 2015‧Board Member, Financial Services Development Council

- 2016‧CEO & Executive Director, Asia Insurance

- 2019‧CEO & Executive Director, Avo Insurance

- 2021‧Chairlady of Hong Kong Federation of Insurers

"CU Alumni Magazine" Video Interview: https://youtu.be/0qL4rJnnKZ4 (Chinese only)

Published in "CU Alumni Magazine" Issue 113 by Alumni Affairs Office 2023

Read online: CU Alumni Magazine Issue No. 113 (Chinese Version Only)

pdf version: http://alumni.cuhk.edu.hk/en/magazine/categories/pdfversion/202303

ISSUU version: http://www.alumni.cuhk.edu.hk/magazine/issuu/